I hope this is helpful is you are thinking of selling a property and may want to do a 1031 Tex Deferred Exchange.

Call me to discuss your situation at 619-846-1244 George Lorimer

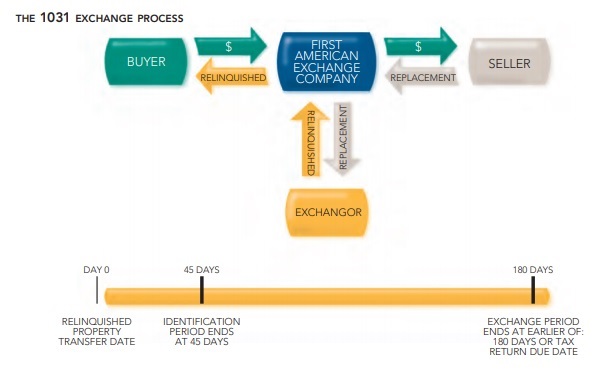

The process is simple when you work with the experienced exchange professionals at First American. Find out how much your property will sell for

STEP 1: Purchase Contract — relinquished property You and your buyer enter into a purchase contract with respect to the sale of your property (known as the “relinquished property”). This relinquished property purchase contract should contain a “cooperation clause” obligating the buyer to cooperate in structuring the transaction as a taxdeferred exchange. A sample cooperation clause may look like: Buyer acknowledges that Seller intends to perform a tax-deferred exchange pursuant to Section 1031 of the Internal Revenue Code. Buyer agrees to an assignment of this contract by Seller (“Exchangor”) to First American Exchange Company, a qualified intermediary, to effectuate the exchange. Buyer agrees to cooperate in such exchange provided that Buyer incurs no cost or liability.

Are you getting enough rent on your income property? Check here for a rent survey

STEP 2: Relinquished property exchange documents Next, contact First American Exchange to start the tax-deferred exchange process. We will prepare an Exchange Agreement, an assignment of the relinquished property purchase contract (assigning your rights as seller to us), a Notice of the assignment (for delivery to the buyer), and instructions to the settlement agent necessary to complete the transaction. All of these documents must be signed and dated before or as of the date of closing.

Search for available homes

STEP 3: Closing the relinquished property When the conditions of closing have been met, your relinquished property will be conveyed to the buyer. While the conveyance will be directly from you to the buyer, it will represent a transfer from you to First American Exchange in exchange R

STEP 4: Relinquished property proceeds and forms Following the relinquished property closing, First American Exchange will hold the exchange proceeds and provide you with forms to identify potential replacement properties within the 45-day identification period.

STEP 5: Purchase Contract—replacement property After you have identified suitable “like-kind” replacement properties and made a decision as to which identified properties you intend to acquire, you will enter into a purchase contract with the seller. This replacement property purchase contract should also contain a “cooperation clause” obligating the seller to cooperate with you in completing your taxdeferred exchange. A sample cooperation clause may look like: Seller acknowledges that buyer intends to perform a tax-deferred exchange pursuant to Section 1031 of the Internal Revenue Code. Seller agrees to an assignment of the contract by buyer to First American Exchange Company, a qualified intermediary, to effectuate the exchange. Seller agrees to cooperate in such exchange, provided that Seller incurs no cost, or liability.

STEP 6: Replacement property exchange documents First American Exchange will then prepare an assignment of the replacement property purchase contract (assigning your rights as buyer to us), notice of the assignment (for delivery to the seller), and instructions to the settlement agent necessary to complete the transaction. All of these documents must be signed before or as of the date of closing.

STEP 7: Closing the replacement property When the conditions of closing have been met, First American Exchange will deliver the exchange proceeds to the settlement agent to acquire the replacement property. The seller will convey the replacement property directly to you. This conveyance will represent a purchase from the seller by First American Exchange and a transfer to you in completion of the exchange. Remember that, to qualify for tax-deferred treatment, this closing must occur by the earlier of 180 days from the date of closing on your first relinquished property or the due date of filing your federal income tax return for the year in which your first relinquished property was sold, including extensions.

STEP 8: Keeping you informed and final reconciliation Prior to or at the conclusion of your exchange, First American Exchange will provide you with a copy of your exchange documents, including a statement reflecting the receipt and disbursement of all exchange funds. With this information, you and your tax advisor will complete Form 8824 to be filed with your federal income tax return, as well as any state forms required to report the transaction as an exchange. First American Exchange understands the importance of having complete and accurate documentation of your exchange transaction in the event you are audited.

RELINQUISHED $ REPLACEMENT FIRST AMERICAN EXCHANGE COMPANY SELLER EXCHANGOR RELINQUISHEDREPLACEMENT the 1031 exchange process 45 DAYS IDENTIFICATION PERIOD ENDS AT 45 DAYS RELINQUISHED PROPERTY TRANSFER DATE DAY 0 180 DAYS EXCHANGE PERIOD ENDS AT EARLIER OF: 180 DAYS OR TAX RETURN DUE DATE $ SPECIAL CIRCUMSTANCES TO BE CONSIDERED Certain provisions of the regulations must be taken into account for the qualifications, structure, and documentation of your exchange.

Please let us know if any of the following circumstances apply to your transaction, so that we may provide you with additional information for you and your tax advisor to consider: Disposing of a property held by a partnership, corporation, or limited liability company Exchanging property with a related party Disposing of property held in a living trust Receiving cash from the exchange Acquiring property of a lesser value than the relinquished property Carrying financing on the relinquished property (seller carryback note) Acquiring replacement property in the following tax year Requiring a reverse exchange transaction Improvements that will be made to the replacement property (construction/improvement exchanges) Acquiring replacement property with spouse or others whom were not a party to the exchange Performing a combination exchange, part investment property (§1031) and part owner occupied (§121) Residing in a state other than the relinquished property. Info provided by firstexchange.com/

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !