July 2020 San Diego Report on Housing Inventory

Your Home Sold GUARANTEED, or I'll Buy It!*

Call George Lorimer

& Start Packing 619-846-1244

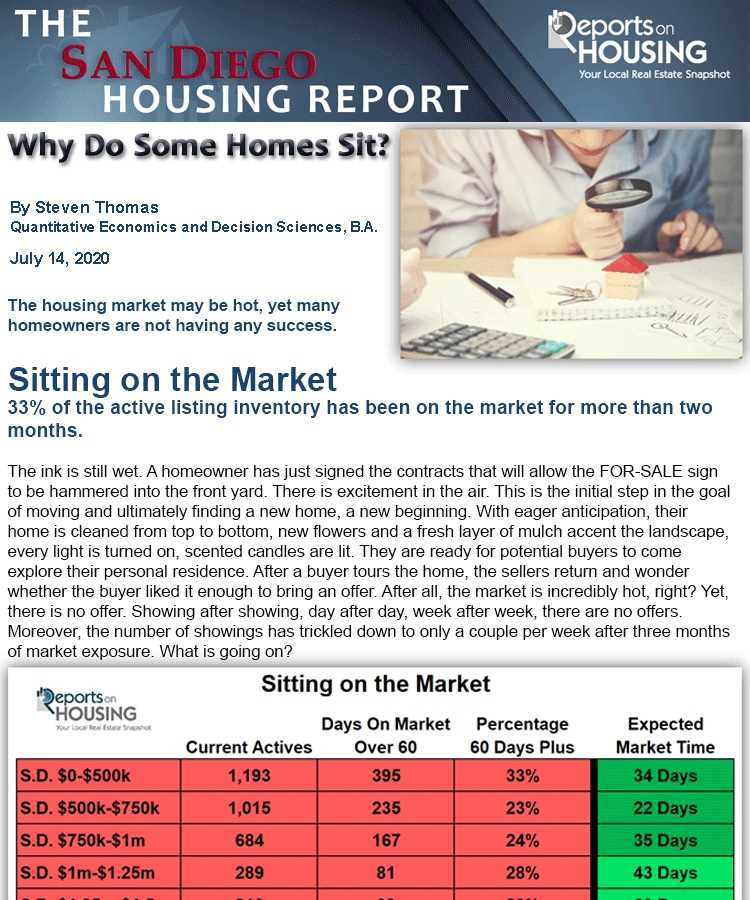

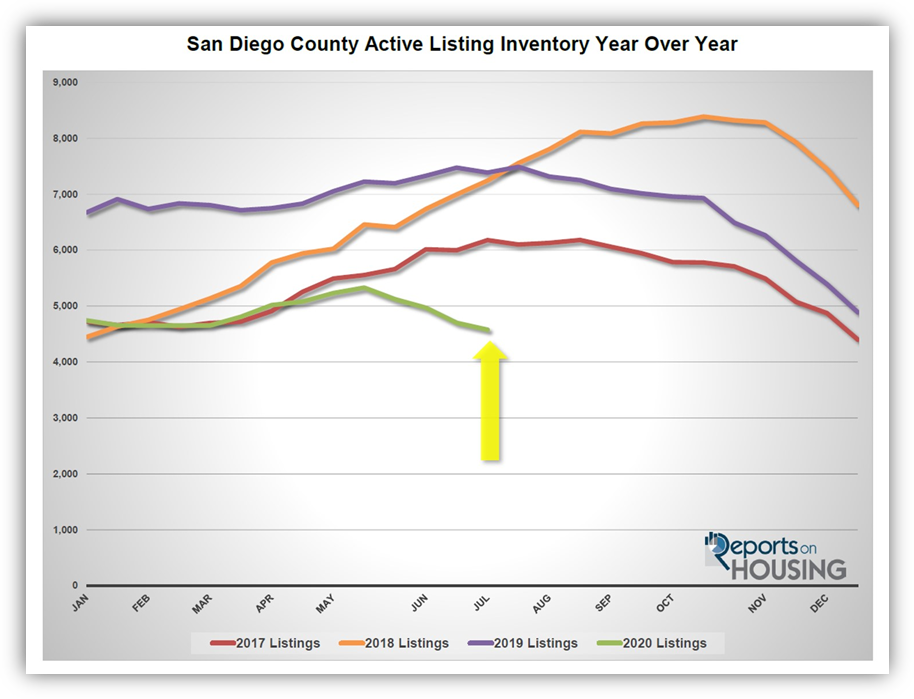

The active listing inventory decreased by 124 homes in the past two weeks, down 3%, and now totals 4,577, its lowest level for July since 2015. In the past four-weeks, 15% fewer homes were placed on the market compared to the prior 5-year average. It was a 42% difference at the end of April; thus, COVID-19’s grip on suppressing the inventory is diminishing. Last year, there were 7,388 homes on the market, 2,811 more than today, or an extra 61%.

Click here to Find Out What Homes Are Selling for in Your Area

Search for Homes Click Here

Demand, the number of pending sales over the prior month, decreased by 137 pending sales in the past two weeks, down 4%, and now totals 3,625, still the highest level for July since tracking began in 2012. COVID-19 currently has no effect on demand. Last year, there were 3,074 pending sales, 15% fewer than today.

The Expected Market Time for all of San Diego County increased slightly from 37 days to 38, a Hot Seller’s Market (less than 60 days). It was at 72 days last year, much slower than today.

For homes priced below $750,000, the market is a Hot Seller’s Market (less than 60-days) with an expected market time of 27 days. This range represents 48% of the active inventory and 67% of demand.

For homes priced between $750,000 and $1 million, the expected market time is 35 days, a Hot Seller’s Market. This range represents 15% of the active inventory and 16% of demand.

For homes priced between $1 million to $1.25 million, the expected market time is 43 days, a Hot Seller’s Market. This range represents 6% of the active inventory and 6% of demand.

For luxury homes priced between $1.25 million and $1.5 million, in the past two weeks, the Expected Market Time increased from 62 to 69 days. For homes priced between $1.5 million and $2 million, the Expected Market Time decreased from 97 to 85 days. For luxury homes priced between $2 million and $4 million, the Expected Market Time decreased from 137 to 121 days. For luxury homes priced above $4 million, the Expected Market Time decreased from 316 to 262 days.

The luxury end, all homes above $1.25 million, accounts for 31% of the inventory and only 12% of demand.

Distressed homes, both short sales, and foreclosures combined, made up only 0.5% of all listings and 0.8% of demand. There are only 15 foreclosures and 9 short sales available to purchase today in all of San Diego County, 24 total distressed homes on the active market, down 7 from two weeks ago. Last year there were 43 total distressed homes on the market, a bit more than today.

There were 3,137 closed residential resales in June, 4% more than June 2019 when there were 3,026 closed sales. June marked a 58% increase over May 2020. The sales to list price ratio was 98% for all of San Diego County. Foreclosures accounted for just 0.4% of all closed sales, and 0.5% of all sales were short sales. That means that 99.1% of all sales were good ol’ fashioned sellers with equity.