What if all of these San Diego forbearances turn into foreclosures?

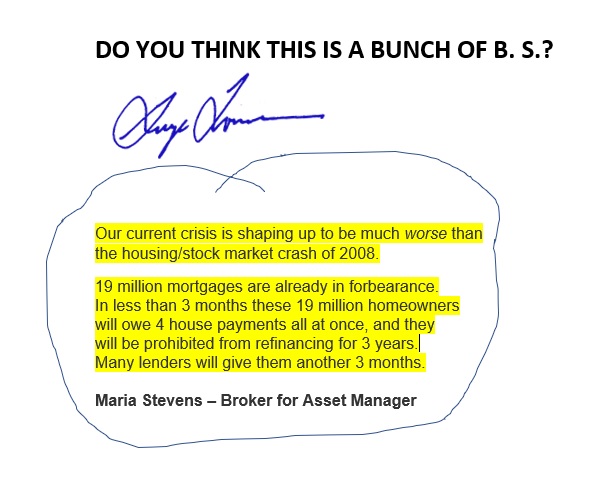

Check out this "industry" email I got yesterday. My first thought was that's B.S.; I see just the opposite; the market is red hot.

I kept thinking, what am I missing?

Then I became worried because many of my customers are waiting, and if forbearances happen, it will erode their equity, fast.

We're still in a hot seller's market. Right now, we have very low inventory and colossal buyer demand.

But, what concerns me is that we're going on the 13th year of a booming market.

The average cycle is 7 years. San Diego could be due for a correction.

The last San Diego downturn was 2008, and now we are at record-high prices.

1. What's the upside of waiting? The prices could go up, maybe 5%.

2. What's the downside? The prices could go down as much as 15%; tax law could change on profit, mortgage rates could go up, buyer demand could drop off.

I wanted to forward you this perspective. If you believe there is a greater risk of waiting than selling now, call/text me, George Lorimer 619-846-1244

Did you know that as your home price peaks, it will eventually flatten or decline? The reason is buyers' income is limited, and as prices go up, fewer of them can afford a home. This "TIPPING POINT" from appreciation to flatting could be soon.

The median price home is $728,500, which means a buyer needs to make $128,772 a year & a $145,600 down payment to qualify for a loan. If you see how San Diego home prices might flatten, Call me to discuss.

I've been through 3 recessions & 1000+ San Diego homes sold. I can help guide you through this. Thanks,

George

619-846-1244

Click here to get an updated price

Categories:

George Lorimers Real Estate Newsletter

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !