San Diego County Housing Report:

Ch-Ch-Ch-Changes

April 12, 2022

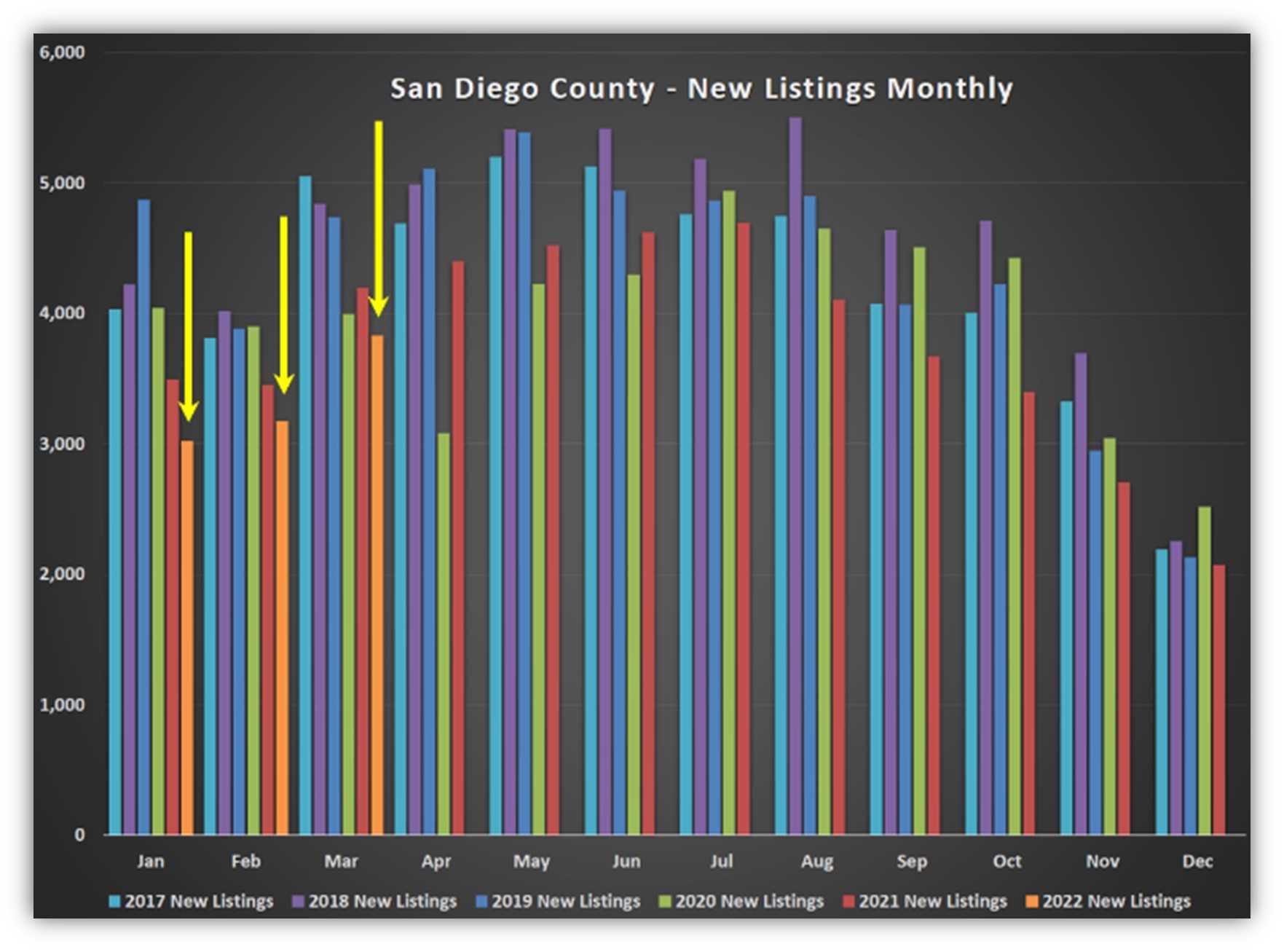

With rates inching their way up to 5%, the housing market is slowly changing and trends are emerging that illustrate a shift in the insanely hot housing market.

New Trends Emerge

As rates zoom upwards, home affordability is beginning to impact the housing market in several profound and meaningful ways.

The scent of orange tree blossoms is captivating. It is just the beginning of the slow metamorphosis from flower to fruit. After the flower blooms, it takes navel oranges seven to 12 months to mature. It is far from instant, but as the petals drop, it reveals a tiny, green fruit that will eventually become a juicy, ripe orange.

Similarly, the evolution of the housing market is far from instant. It does not change like a snap of the fingers. Higher rates are like the orange blossom, just the beginning of a slow metamorphosis from an insane, out-of-control housing market to a slower, more balanced, normal housing market. It takes time, but new trends are already emerging.

Rapidly rising rates mean affordability has taken a dramatic hit so far this year. According to the Mortgage Bankers Association®, interest rates have risen from 3.31% on December 29th to 4.8% on March 30th, representing a 45% increase. The purchasing power for buyers has rapidly eroded in such a short period of time. For a buyer looking to put 10% down and desiring a $4,000 per month payment, at the end of December they were looking at a $1,013,333 home. Today, that same buyer is now looking at homes just below $850,000. Another way of looking at it is how much more the payment is on a $1 million home. At 3.31% with 10% down, the payment would be $3,947 per month versus $4,772 per month at 4.8% today. That is an additional $884 per month, or $10,608 per year. Persistent higher rates will eventually diminish demand and, ultimately, throttle back...

Click here for the full report

Ch-Ch-Ch-Changes

April 12, 2022

With rates inching their way up to 5%, the housing market is slowly changing and trends are emerging that illustrate a shift in the insanely hot housing market.

New Trends Emerge

As rates zoom upwards, home affordability is beginning to impact the housing market in several profound and meaningful ways.

The scent of orange tree blossoms is captivating. It is just the beginning of the slow metamorphosis from flower to fruit. After the flower blooms, it takes navel oranges seven to 12 months to mature. It is far from instant, but as the petals drop, it reveals a tiny, green fruit that will eventually become a juicy, ripe orange.

Similarly, the evolution of the housing market is far from instant. It does not change like a snap of the fingers. Higher rates are like the orange blossom, just the beginning of a slow metamorphosis from an insane, out-of-control housing market to a slower, more balanced, normal housing market. It takes time, but new trends are already emerging.

Rapidly rising rates mean affordability has taken a dramatic hit so far this year. According to the Mortgage Bankers Association®, interest rates have risen from 3.31% on December 29th to 4.8% on March 30th, representing a 45% increase. The purchasing power for buyers has rapidly eroded in such a short period of time. For a buyer looking to put 10% down and desiring a $4,000 per month payment, at the end of December they were looking at a $1,013,333 home. Today, that same buyer is now looking at homes just below $850,000. Another way of looking at it is how much more the payment is on a $1 million home. At 3.31% with 10% down, the payment would be $3,947 per month versus $4,772 per month at 4.8% today. That is an additional $884 per month, or $10,608 per year. Persistent higher rates will eventually diminish demand and, ultimately, throttle back...

Click here for the full report

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !