I've seen from most experts that there won't be a drop in San Diego house prices.

Is the affordability is at an all-time low? Yep

The mortgage rates are sticky and staying higher than experts expected. Yep

Then why aren't prices dropping?

The supply of available homes and buyers' demand are in equilibrium, creating a balanced market.

There are 30% more homes on the market from a year ago, but only approximately 4100 homes/condos for sale. And 1800+ sales every month. That is only a 2.2-month supply of homes.

For free advice on your situation on buying or selling a home, call or text George Lorimer at 619-846-1244.

San Diego County Housing Summary

Is the affordability is at an all-time low? Yep

The mortgage rates are sticky and staying higher than experts expected. Yep

Then why aren't prices dropping?

The supply of available homes and buyers' demand are in equilibrium, creating a balanced market.

There are 30% more homes on the market from a year ago, but only approximately 4100 homes/condos for sale. And 1800+ sales every month. That is only a 2.2-month supply of homes.

For free advice on your situation on buying or selling a home, call or text George Lorimer at 619-846-1244.

San Diego County Housing Summary

- The active listing inventory decreased by 422 homes, down 9%, in the past couple of weeks and now stands at 4,136. For November, 2,178 new sellers entered the market in San Diego County, 1,145 fewer than the 3-year average before COVID (2017 to 2019), 34% less. Last November, there were 2,037 new sellers, 6% less than this year. Last year, there were 2,898 homes on the market, 1,238 fewer homes, or 30% less. The 3-year average before COVID (2017 to 2019) was 5,905, or 43% extra, much higher.

Find Out What Homes in Your Neighborhood are Selling For

- Demand, the number of pending sales over the prior month, decreased from 1,605 to 1,489 in the past couple of weeks, down 7%. Last year, there were 1,305 pending sales, 184 fewer or 12% less. The 3-year average before COVID (2017 to 2019) was 2,266, or 52% more.

- With supply falling faster than demand, the Expected Market Time (the number of days it takes to sell all San Diego County listings at the current buying pace) decreased from 85 to 83 days in the past couple of weeks. Last year, it was 67 days, much faster than today. The 3-year average before COVID was 80 days, similar to today.

- In the past two weeks, the Expected Market Time for homes priced below $750,000 increased from 78 to 79 days. This range represents 32% of the active inventory and 34% of demand.

Get Multiple Cash Offers on Your Home

- The Expected Market Time for homes priced between $750,000 and $1 million decreased from 68 to 62 days. This range represents 21% of the active inventory and 27% of demand.

- The Expected Market Time for homes priced between $1 million and $1.25 million increased from 82 to 105 days. This range represents 11% of the active inventory and 11% of demand.

- The Expected Market Time for homes priced between $1.25 million and $1.5 million decreased from 87 to 82 days. This range represents 9% of the active inventory and 9% of demand.

- The Expected Market Time for homes priced between $1.5 million and $2 million decreased from 96 to 82 days. This range represents 9% of the active inventory and 9% of demand.

- In the past two weeks, the Expected Market Time for homes priced between $2 million and $4 million decreased from 120 to 113 days. The Expected Market Time for homes priced between $4 million and $6 million increased from 162 to 179 days. The Expected Market Time for homes priced above $6 million decreased from 527 to 375 days.

- The luxury end, all homes above $2 million, account for 18% of the inventory and 10% of demand.

- Distressed homes, both short sales and foreclosures combined, comprised only 0.3% of all listings and 0.4% of demand. Only five foreclosures and nine short sales are available today in San Diego County, with 14 total distressed homes on the active market, down three from two weeks ago. Last year, 19 distressed homes were on the market, similar to today.

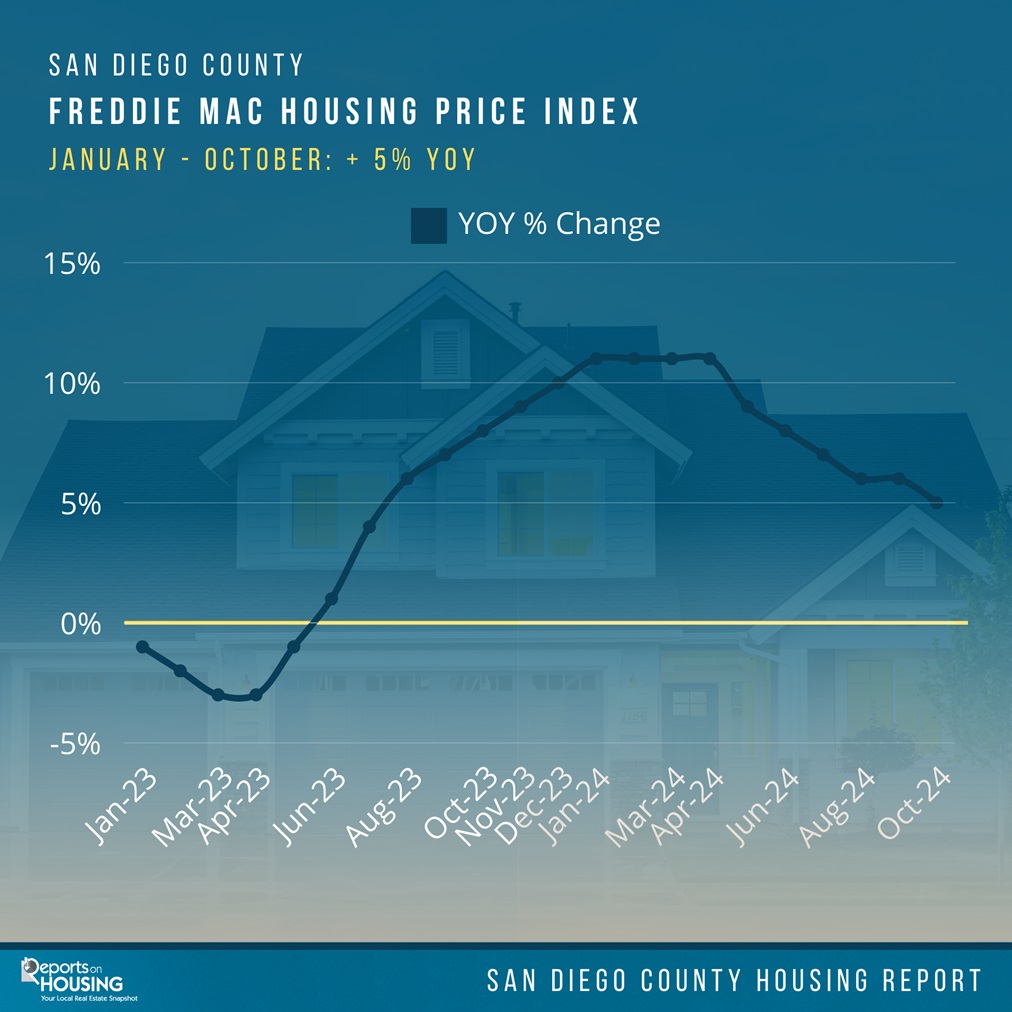

- There were 2,025 closed residential resales in October, up 16% from October 2023’s 1,753 closed sales. October marked a 10% increase compared to September 2024. The sales-to-list price ratio was 98.8% for all of San Diego County. Foreclosures accounted for only 0.15% of all closed sales, and short sales accounted for 0.05% of all closed sales. That means that 99.8% of all sales were good ol’ fashioned sellers with equity.

Get More Stats

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !